It is important to understand how your health care plan operates, but far too often the tricky benefit jargon of “deductible, coinsurance, copay, and out-of-pocket max” get in the way. These hard to understand health care vocabulary terms are explained below to help make understanding your health care plan much simpler!

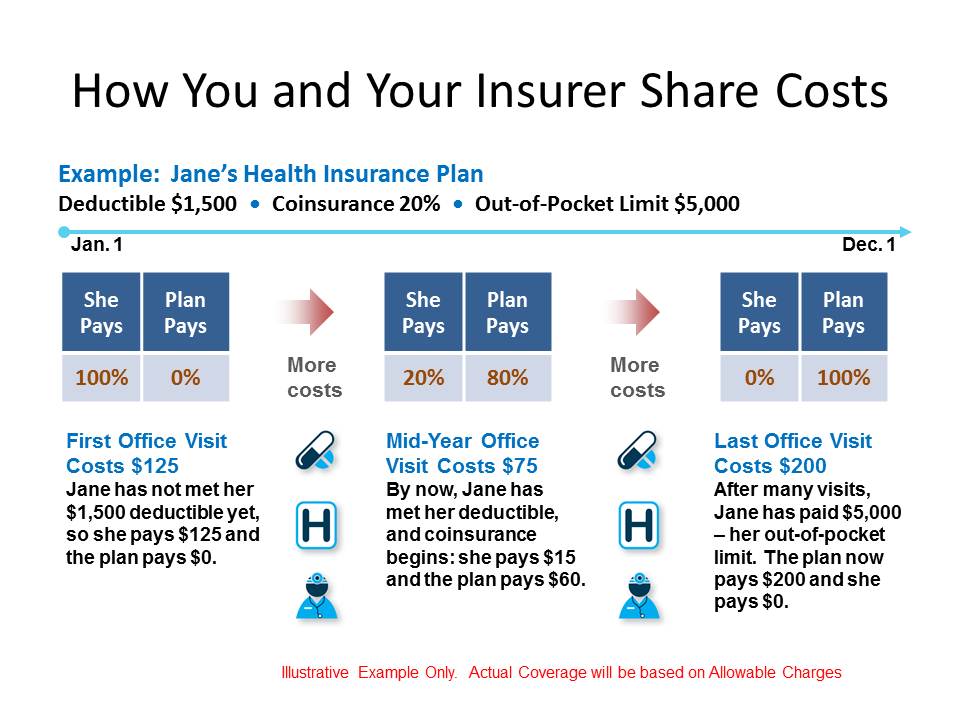

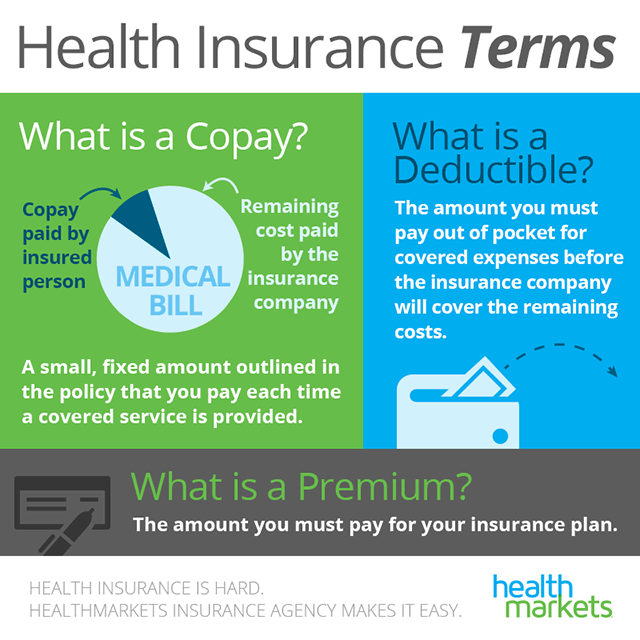

Deductible – the amount of out-of-pocket expenses you pay for covered health care services before the insurance plan begins to pay.

Jace Estremera Week 13 Assignment April 10, 2021 Features of Health Insurance Plans Copays and deductibles are features of health insurance plans. They involve payment on the part of the insured, but the amount and frequency differ. A copay, short for copayment, is a fixed amount a healthcare beneficiary pays for covered medical services (O’Sullivan et. $5 copay/Per Prescription, Deductible does not apply at retail, $15 copay/per 90 day supply, Deductible does not apply at mail Formulary High Cost: $25 copay/Per Prescription, Deductible does not apply at retail, $75 copay/per 90 day supply, Deductible does not apply at mail Non-formulary: Not covered Formulary: 50% coinsurance at retail, mail.

| HSA-Eligible Plan | All covered services require you to meet your deductible first and then services will be covered through coinsurance. |

| PPO Plan | Some covered services require you to meet the deductible first, while other covered services are paid with a copay. |

| Helpful Hint! | The health plan comparison chart shows deductible amounts for Tier 1, Tier 2 and Tier 3, but you should think of your deductible as one sum of the money you have paid for your services. |

| Example | With a $1500 Tier 1 deductible on the HSA-Eligible Plan with single coverage, you pay the first $1500 of covered services yourself. If you have met this, you would pay an additional $100 towards your services and then would have met the Tier 2 deductible of $2,500. |

Coinsurance – the percentage of cost of a covered health care service you pay once you have met your deductible.

| HSA-Eligible and PPO Plans | For services covered by “coinsurance after deductible” the amount you pay in co-insurance continues to count towards meeting your next Tier deductible. |

| Coinsurance % | Most Tier 1 services are covered at “90% coinsurance after deductible,” while Tier 2 services are “75% after deductible and Tier 3 are “60% after deductible.” |

| Example | If you are on either plan and have hit your Tier 1 deductible and visit a Tier 1 urgent care provider, the plan covers that service at “90% coinsurance after deductible.” This means you will pay 10% of the cost of the visit and your insurance will cover the remaining 90%. The 10% you pay will count towards your deductible. |

Copay – a fixed dollar amount you must pay to a provider at the time services are received.

| PPO Plan | Only the PPO Plan offers a copay option for specific covered services. Your copay does not count towards your deductible. |

| Copay Amounts | Copay amounts vary based on the plan design. The health plan comparison chart is the best resource to understand what your copay is for a covered service within any of the tiers. |

| Example | If you are on the PPO plan and you see a Tier 1 provider for a standard sick visit, then your copay at the time of the visit will be $20. If you seek a Tier 1 provider for physical therapy, then your copay will be $35. |

Out-of-Pocket Max – the maximum amount you pay each calendar year to receive covered services after you meet your deductible. Once you meet your out-of-pocket maximum, the Plan pays 100% of covered services you receive. In network and out-of-network services are subject to separate out-of-pocket maximums.

Coinsurance Vs Deductible

| HSA-Eligible and PPO Plans | Your out-of-pocket max is the summation of everything you have paid for your medical services received; this includes deductible, coinsurance and copay. |

| Helpful Hint! | Out-of-pocket max’s are determined by coverage level (single vs plan with dependents) and salary. On the health plan comparison chart you will see multiple rows with Out-of-Pocket Max figures, so be sure to look in the row that pertains to your situation. |